Americans of all ages are increasingly worried about their finances now that the coronavirus has infected the economy. So far, the media coverage has focused more on the fallout for working families who are struggling to make ends meet, after losing their jobs, and income, as businesses shutter for the foreseeable future. There’s been far less attention to the financial impact on older adults, who are not only at higher risk of serious illness if they get the coronavirus, but also financially vulnerable if the pandemic leads to a sustained drop in their income and retirement savings. Seniors already face significant out-of-pocket costs for their health care and as a share of their income.

It doesn’t take much to imagine how the coronavirus economy could lead to a drop in both income and retirement savings for seniors for an unknown period of time. Older adults 50 and older who lose their jobs in the wake of the pandemic may find it more difficult than younger workers to get jobs and comparable compensation when the economy begins to recover. And, while some of the 12 million adults ages 65 and older choose to work mainly for professional or personal fulfillment, others do so to pay their bills, often to help support their children and grandchildren. More than 4 million adults ages 65 or older who worked at some time during the year were in families with incomes below 400% of poverty, including a disproportionate share of black and Hispanic seniors, according to an unpublished KFF analysis. Older adults who decide to collect Social Security to compensate for lost earnings, but before their full retirement age, will get lower monthly payments than they would have for the rest of their lives.

We recently released new data that paints a fairly dim picture of seniors’ financial resources in 2019 — before the coronavirus pandemic. These 2019 estimates are likely to be a high-water mark for older adults, at least for the foreseeable future, given relatively high unemployment among older workers and volatility in the stock market, which can affect retirement savings.

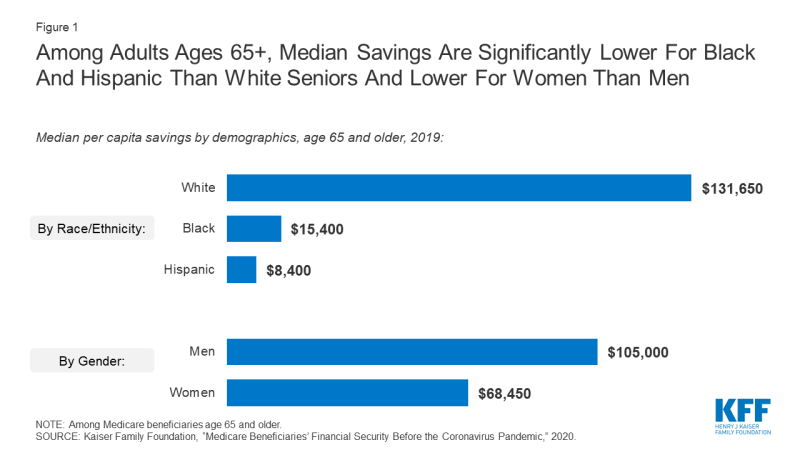

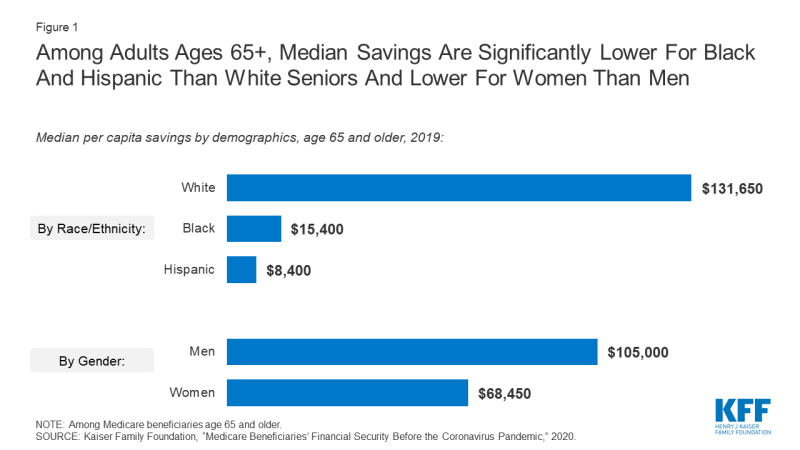

In 2019, as in prior years, the distribution of savings among seniors is highly skewed: the top five percent of seniors had savings of more than $1.4 million per person. However, even before the economy started to falter, half of all seniors had savings of $83,850 or less, a quarter had less than $9,650, and about one in ten (12%) no had no savings at all. Median savings among adults ages 65 and older were substantially lower for black and Hispanic than white seniors, and lower for older women than older men (Figure 1).

Among Adults Ages 65+, Median Savings Are Significantly Lower For Black And Hispanic Than White Seniors And Lower For Women Than Men

For older adults with some or all of their retirement savings invested the stock market, the recent volatility raises uncertainty, more for some than others. The average age 65 and older household with any savings invested about one fifth (18%, on average) of total savings in the stock market in 2016; the share was very low among older households with savings in the bottom savings quintile (<1%, on average) but much higher (36%, on average) among older households in the top savings quintile. The volatility in the stock market raises particular concern for older retirees who have fewer years than younger adults to recover lost retirement savings from a downturn in the economy.

The recently enacted CARES Act aims to mitigate the immediate impact of economic losses on Americans, including older Americans, such as direct payments of up to $1,200 to individuals and more generous unemployment benefits. However, these are short-term solutions to what appears to be a long-term problem. The economic impact of the coronavirus economy on older Americans has important implications for the current response to COVID, and future policy discussions pertaining to Medicare, Medicaid and Social Security.

By Apr 24, 2020